MOUNTAIN VIEW, Calif., Nov. 2, 2020

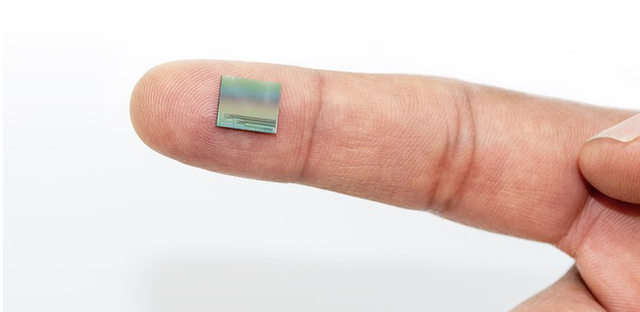

Aeva’s 4D LiDAR on Chip

Aeva’s 4D LiDAR on Chip

Highlights

- Aeva Inc. (“Aeva”) is the leading provider of comprehensive perception solutions developed on Silicon Photonics for mass scale applications in automotive, consumer electronics, consumer health, industrial and security markets.

- Aeva’s groundbreaking 4D LiDAR on Chip combines instant velocity measurements and long-range performance at affordable costs for commercialization at silicon scale.

- Aeva has received strategic investments from Porsche SE, the major shareholder of VW Group.

- Aeva’s commercial partners also include other top automotive OEMs and world’s leading mobility and technology players.

- In September, Aeva announced a production partnership with ZF to manufacture and distribute the first automotive grade 4D LiDAR to global OEM customers.

- Business combination to provide up to$363Min gross proceeds, comprised of InterPrivate’s$243Mheld in trust[1]and a$120Mfully committed common stock PIPE at$10.00per share, including investments from Adage Capital and Porsche SE.

- Combined company expected to have an estimated post-transaction equity value of approximately$2.1Band is expected to be listed on the NYSE under the ticker symbol AEVA following anticipated transaction close in Q1 2021.

- All Aeva stockholders, including Lux Capital, Canaan Partners, and Lockheed Martin, will retain their equity holdings through Aeva’s transition into the publicly listed company.

- Aeva plans to use 100% of the net proceeds from the transaction to accelerate its growth and commercialization.

InterPrivate Acquisition Corp (“InterPrivate”) (NYSE:IPV), a special purpose acquisition company, announced today that it has entered into a definitive agreement for a business combination with Aeva, Inc. (“Aeva”), the first company to provide a perception platform built from the ground up on Silicon Photonics for mass scale application in automotive, consumer electronics and other sectors. Upon closing of the transaction, the combined company will be renamed “Aeva, Inc.” and is expected to continue to be listed on the New York Stock Exchange and trade under the ticker symbol “AEVA.”

Founded in 2017 by former Apple engineersSoroush SalehianandMina Rezkand led by a multidisciplinary team of over 100 experienced leaders, engineers, and operators, Aeva is actively engaged with thirty of the top players in automated and autonomous driving across passenger, trucking and mobility.

- In 2019, Aeva announced a partnership with Audi’s Autonomous Intelligent Driving entity. Aeva has also partnered with multiple other passenger car, trucking and mobility platforms to further adoption of ADAS and autonomous applications.

- Aeva is in a production partnership with ZF, one of the world’s largest automotive Tier 1 manufacturers to top OEMs, to supply the first automotive grade 4D LiDAR from select ZF production plants. The partnership — Aeva’s expertise in FMCW LiDAR technology combined with ZF’s experience in industrialization of automotive grade sensors — represents a key commitment to accelerate mass production of safe and scalable 4D LiDAR technology.

With its powerful software stack, Aeva plans to bring its perception platform to a range of industries beyond automotive, including consumer electronics, consumer health, industrial robotics, and security.

Unlike legacy LiDAR, which relies on Time of Flight (ToF) technology and measures only depth and reflectivity, Aeva’s groundbreaking solution uses a unique Frequency Modulated Continuous Wave (FMCW) technology to measure velocity in addition to depth, reflectivity and inertial motion. Aeva’s innovative FMCW technology draws on significantly less power than other available technologies, including ToF, to bring perception to broad applications at an industry-leading cost.

“From the beginning our vision has been to create a fundamentally new sensing system to enable perception across all devices. This milestone accelerates our journey toward delivering the next paradigm in perception to mass market applications, not just in automotive but consumer and beyond,” saidSoroush Salehian, Co-founder and CEO at Aeva.

Mina Rezk, Co-founder and CTO at Aeva, said, “From the beginning, we believed that the only way to achieve the holy grail of LiDAR is to be integrated on a chip. Over the last four years, we did it by leveraging Aeva’s unique coherent FMCW approach. With today’s announcement, we can use our development efforts to expand into new markets that were simply not possible before.”

Ahmed Fattouh, Chairman and Chief Executive Officer of InterPrivate said, “We look forward to our combination with Aeva, which was the clear stand-out amongst the 100+ merger targets we evaluated. The Company’s breakthrough technology combines the key advantages of LiDAR, Radar, Motion Sensing, and Vision in a single compact chip. As a result of this transaction, including the upsized PIPE private placement, Aeva is not expected to require any additional funding to achieve significant cash flow through its commercial partnerships with world class customers. Soroush, Mina and their team are revolutionizing sensing solutions not only for the automotive industry, but ultimately across all devices.”

Transaction overview

The combined company will have an implied pro forma equity value of approximately$2.1 billionat closing, and Aeva’s existing stockholders will hold approximately 80% of the issued and outstanding shares of common stock of the combined company immediately following the closing.

Cash proceeds in connection with the transaction will be funded through a combination of (i) the issuance of approximately$120 millionof common stock through a fully committed private placement at$10.00per share, including investments from Adage Capital and Porsche SE, (ii) the issuance of$ 1.7 billionof new common stock of InterPrivate to current stockholders of Aeva subject to customary adjustments and (iii)$243 millionof cash held in trust assuming no redemptions by InterPrivate’s existing public stockholders.

The boards of directors of both InterPrivate and Aeva have unanimously approved the proposed business combination. Completion of the proposed business combination is subject to, among other things, the approval by InterPrivate and Aeva stockholders and the satisfaction or waiver of other customary closing conditions, including a registration statement being declared effective by the Securities and Exchange Commission (the “SEC”), and is expected to occur in the first quarter of 2021.

Following completion of the transaction, Aeva will retain its experienced management team.Soroush Salehianwill continue to serve as Chief Executive Officer,Mina Rezkwill continue to serve as Chief Technology Officer andSaurabh Sinhawill continue to serve as Chief Financial Officer.

Advisors

Morgan Stanley & Co. LLC is serving as financial advisor and lead private placement agent on the PIPE offering, and Greenberg Traurig is serving as legal advisor to InterPrivate. Credit Suisse Securities (USA) LLC is acting as capital markets advisor, and Latham & Watkins LLP is serving as legal advisor to Aeva. Credit Suisse Securities (USA) LLC also served as placement agent on the PIPE offering for InterPrivate. Additionally,Davis Polk& Wardwell LLP is serving as legal counsel to Morgan Stanley & Co. LLC and Credit Suisse Securities (USA) LLC.

Investor Conference Call

To listen to the investor conference call,click here.

About Aeva

Aeva was founded in 2017 bySoroush SalehianandMina Rezk, both of whom are former engineering leaders at Apple & Nikon. Headquartered inMountain View, California, Aeva is building the next-generation of sensing and perception for autonomous vehicles and beyond. Aeva is backed by Adage Capital, Porsche SE, Lux Capital and Canaan Partners, amongst others. For more information, visitwww.aeva.com.

About InterPrivate Acquisition Corp.

InterPrivate is a blank check company organized for the purpose of effecting a merger, share exchange, asset acquisition, stock purchase, recapitalization, reorganization, or other similar business combination with one or more businesses or entities. InterPrivate is controlled by affiliates ofAhmed M. Fattouh, Chairman and Chief Executive Officer, and InterPrivate LLC, a private investment firm founded by Mr. Fattouh that invests on behalf of a consortium of family offices in partnership with independent sponsors from the private equity and venture capital industries. InterPrivate focused its efforts on evaluating business combination targets by leveraging InterPrivate’s network of independent sponsors, family offices and private equity and venture capital firms. InterPrivate is an emerging growth company as defined in the Jumpstart Our Business Startups Act of 2012.

Forward-Looking Statements

This press release contains certain forward-looking statements within the meaning of the federal securities laws with respect to the proposed transaction between Aeva and InterPrivate, including statements regarding the benefits of the transaction, the anticipated timing of the transaction, the services offered by Aeva and the markets in which it operates, and Aeva’s projected future results. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this press release, including, but not limited to: (i) the risk that the transaction may not be completed in a timely manner or at all, which may adversely affect the price of InterPrivate’s securities, (ii) the risk that the transaction may not be completed by InterPrivate’s business combination deadline and the potential failure to obtain an extension of the business combination deadline if sought by InterPrivate, (iii) the failure to satisfy the conditions to the consummation of the transaction, including the adoption of the business combination agreement by the stockholders of InterPrivate and Aeva, the satisfaction of the minimum trust account amount following redemptions by InterPrivate’s public stockholders and the receipt of certain governmental and regulatory approvals, (iv) the lack of a third party valuation in determining whether or not to pursue the proposed transaction, (v) the occurrence of any event, change or other circumstance that could give rise to the termination of the agreement and plan of merger, (vi) the effect of the announcement or pendency of the transaction on Aeva’s business relationships, performance, and business generally, (vii) risks that the proposed transaction disrupts current plans of Aeva and potential difficulties in Aeva employee retention as a result of the proposed transaction, (viii) the outcome of any legal proceedings that may be instituted against Aeva or against InterPrivate related to the agreement and plan of merger or the proposed transaction, (ix) the ability to maintain the listing of InterPrivate’s securities on the New York Stock Exchange, (x) the price of InterPrivate’s securities may be volatile due to a variety of factors, including changes in the competitive and highly regulated industries in which Aeva plans to operate, variations in performance across competitors, changes in laws and regulations affecting Aeva’s business and changes in the combined capital structure, (xi) the ability to implement business plans, forecasts, and other expectations after the completion of the proposed transaction, and identify and realize additional opportunities, (xii) the risk of downturns and the possibility of rapid change in the highly competitive industry in which Aeva operates, (xiii) the risk that Aeva and its current and future collaborators are unable to successfully develop and commercialize Aeva’s products or services, or experience significant delays in doing so, (xiv) the risk that Aeva may never achieve or sustain profitability; (xv) the risk that Aeva will need to raise additional capital to execute its business plan, which many not be available on acceptable terms or at all; (xvi) the risk that the post-combination company experiences difficulties in managing its growth and expanding operations, (xvii) the risk that third-parties suppliers and manufacturers are not able to fully and timely meet their obligations, (xviii) the risk of product liability or regulatory lawsuits or proceedings relating to Aeva’s products and services, (xix) the risk that Aeva is unable to secure or protect its intellectual property and (xx) the risk that the post-combination company’s securities will not be approved for listing on the New York Stock Exchange or if approved, maintain the listing. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of InterPrivate’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, the registration statement on Form S-4 and proxy statement/consent solicitation statement/prospectus discussed below and other documents filed by InterPrivate from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Aeva and InterPrivate assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Neither Aeva nor InterPrivate gives any assurance that either Aeva or InterPrivate will achieve its expectations.

Additional Information and Where to Find It

This press release relates to a proposed transaction between Aeva and InterPrivate. This press release does not constitute an offer to sell or exchange, or the solicitation of an offer to buy or exchange, any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, sale or exchange would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. InterPrivate intends to file a registration statement on Form S-4 that will include a proxy statement of InterPrivate, a consent solicitation statement of Aeva and a prospectus of InterPrivate. The proxy statement/consent solicitation statement/prospectus will be sent to all InterPrivate and Aeva stockholders. InterPrivate also will file other documents regarding the proposed transaction with the SEC. Before making any voting decision, investors and security holders of InterPrivate and Aeva are urged to read the registration statement, the proxy statement/consent solicitation statement/prospectus and all other relevant documents filed or that will be filed with the SEC in connection with the proposed transaction as they become available because they will contain important information about the proposed transaction.

Investors and security holders will be able to obtain free copies of the proxy statement/consent solicitation statement/prospectus and all other relevant documents filed or that will be filed with the SEC by InterPrivate through the website maintained by the SEC atwww.sec.gov. In addition, the documents filed by InterPrivate may be obtained free of charge from InterPrivate’s website athttps://ipvspac.com/or by written request to InterPrivate at InterPrivate Acquisition Corp., 1350 Avenue of the Americas,New York, NY10019.

Participants in the Solicitation

InterPrivate and Aeva and their respective directors and officers may be deemed to be participants in the solicitation of proxies from InterPrivate’s stockholders in connection with the proposed transaction. Information about InterPrivate’s directors and executive officers and their ownership of InterPrivate’s securities is set forth in InterPrivate’s filings with the SEC, including InterPrivate’s Annual Report on Form 10-K for the fiscal year endedDecember 31, 2019, which was filed with the SEC onMarch 30, 2020. To the extent that holdings of InterPrivate’s securities have changed since the amounts printed in InterPrivate’s proxy statement, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Additional information regarding the interests of those persons and other persons who may be deemed participants in the proposed transaction may be obtained by reading the proxy statement/consent solicitation statement/prospectus regarding the proposed transaction when it becomes available. You may obtain free copies of these documents as described in the preceding paragraph.

1. All dollar amounts and equity valuations included in this press release assume there are no redemptions from the InterPrivate trust account in connection with the closing of the business combination.

Mina Rezk, Aeva

Mina Rezk, Aeva

Soroush Salehian, Aeva

Soroush Salehian, Aeva

Press Contacts

InterPrivate

Charlotte Luer, Marketing

cluer@interprivate.com

+1-239-404-6785

Aeva

Scott Rubin, Public Relations

press@aeva.ai

+1-415-494-1275

SOURCE InterPrivate Acquisition Corp.